Cash Drawer Shortage Law Texas

Cash Drawer Shortage Law Texas - Employee admits they are responsible for the cash. Breakage, damage, or loss of the employer’s property; Written by attorney michael kelsheimer. The california courts have held that losses occurring without any fault on the part of the employee or that are merely the result of simple. Department of labor states that the fair labor standards act (fsla) allows deductions for cash or merchandise shortages provided that the deductions do not lower the employee’s pay below the federal minimum wage. The employer bears the burden of proving that the employee was personally and directly responsible for the. In most states, deductions for cash register shortages are only allowed in limited circumstances. Web even though paying a tipped employee $2.13 per hour can be thought of as the end result of deducting the tip credit of $5.12 per hour from the required minimum wage of $7.25 per hour, the tip credit does not have to be authorized in writing by the employee in order to be valid under the texas payday law, since it is specifically authorized by th. Pedersen, although you can't deduct their pay even if you've proven that one has stolen from you. Web september 10, 2019 employers are required to make certain payroll deductions from employee paychecks like federal, state, and local taxes. The employer bears the burden of proving that the employee was personally and directly responsible for the. Deduction, minimum wage, pay, payday, payday act, payroll, tip, union. The mayhue's super liquor stores case merits a special look because it illustrates how a court can signal that common sense should prevail in certain situations. From a legal perspective, this shortage is. Insurance software firm and short seller target ebix inc. Web an employer may deduct the amount of cash shortages that are proven to be a result of theft or other misappropriation by the employee, even though such a deduction might take the employee below the minimum wage level; Web even though paying a tipped employee $2.13 per hour can be. Under federal law, employers can charge the employee for these losses, as long as the employee is still earning at least the minimum wage. Web updated march 2, 2020 mistakes happen in the workplace, whether it's accidentally damaging company property, accepting a bad check, or ending up with a shortage in the cash register. Web posted on feb 8, 2021.. Whether or not your employer can charge you for these mistakes depends on federal law and the laws of your state. An employer may withhold the following items from wages only if the employee has consented to it in writing: In most states, deductions for cash register shortages are only allowed in limited circumstances. Retirement planning advice for women Web. Web in texas, the legality of an employer making you repay a short cash drawer largely depends on the specific terms and agreements you've signed with your employer. Has written authorization from the employee to deduct part of the wages for a lawful purpose. Under federal law, employers can charge the employee for these losses, as long as the employee. You have to go through the court system like. In most states, deductions for cash register shortages are only allowed in limited circumstances. Many states, however are more protective. Other premiums are voluntary payroll deductions, like health insurance and disability coverage. Web if the employer is subject to the fair labor standards act, he or she cannot. (2) an employer improperly requires tipped employees to pay for customers who walk out without paying their. Here’s a list of 15 common small business payroll deductions, including mandatory payroll taxes: Tips are the property of the employee and deductions cannot be made because of cash register shortages. Common causes of cash drawer shortages Web federal law is silent on. Web what does federal law say? Web hi all, we are in texas. Web composed by texas riogrande legal aid • last updated on january 10, 2023 here, learn about the rights of tipped employees. Web contents index < > top 10 tips disclaimer; Web 3 attorney answers. Web federal law allows employers to charge employees for items they break or for shortages in their cash register drawers provided the affected employee still earns at least the minimum wage. Web updated march 2, 2020 mistakes happen in the workplace, whether it's accidentally damaging company property, accepting a bad check, or ending up with a shortage in the cash. Has written authorization from the employee to deduct part of the wages for a lawful purpose. Web in texas, the legality of an employer making you repay a short cash drawer largely depends on the specific terms and agreements you've signed with your employer. Tips are the property of the employee and deductions cannot be made because of cash register. When it comes to federal law, the u.s. Common causes of cash drawer shortages In most states, deductions for cash register shortages are only allowed in limited circumstances. Whether or not your employer can charge you for these mistakes depends on federal law and the laws of your state. A concise guide for texas employers regarding permissible deductions from pay and issues with deductions. Web in texas, the legality of an employer making you repay a short cash drawer largely depends on the specific terms and agreements you've signed with your employer. The employer bears the burden of proving that the employee was personally and directly responsible for the. Under federal law, employers can charge the employee for these losses, as long as the employee is still earning at least the minimum wage. Based on the information provided, it's essential to review the contracts and policies you agreed to when you started working at the retail shop and coffee shop. Web employees often want to know whether their employer can force them to pay the cash shortage from their register drawer or compensate the employer for the customer that walked out by. (2) an employer improperly requires tipped employees to pay for customers who walk out without paying their. Tips are the property of the employee and deductions cannot be made because of cash register shortages. Web federal law is silent on the issue of making an employee pay for breakage, a customer's theft, or a shortage in the cash drawer. Many states, however are more protective. Web updated march 2, 2020 mistakes happen in the workplace, whether it's accidentally damaging company property, accepting a bad check, or ending up with a shortage in the cash register. Insurance software firm and short seller target ebix inc.

Cash Shortage Strategies and tips To Survive Money Shortage Issues

A Reprimand Letter for Cash Shortage Writolay

Policy on Cash Shortages Debits And Credits Government

Cash Shortage Warning Letter 4 Free Templates Writolay

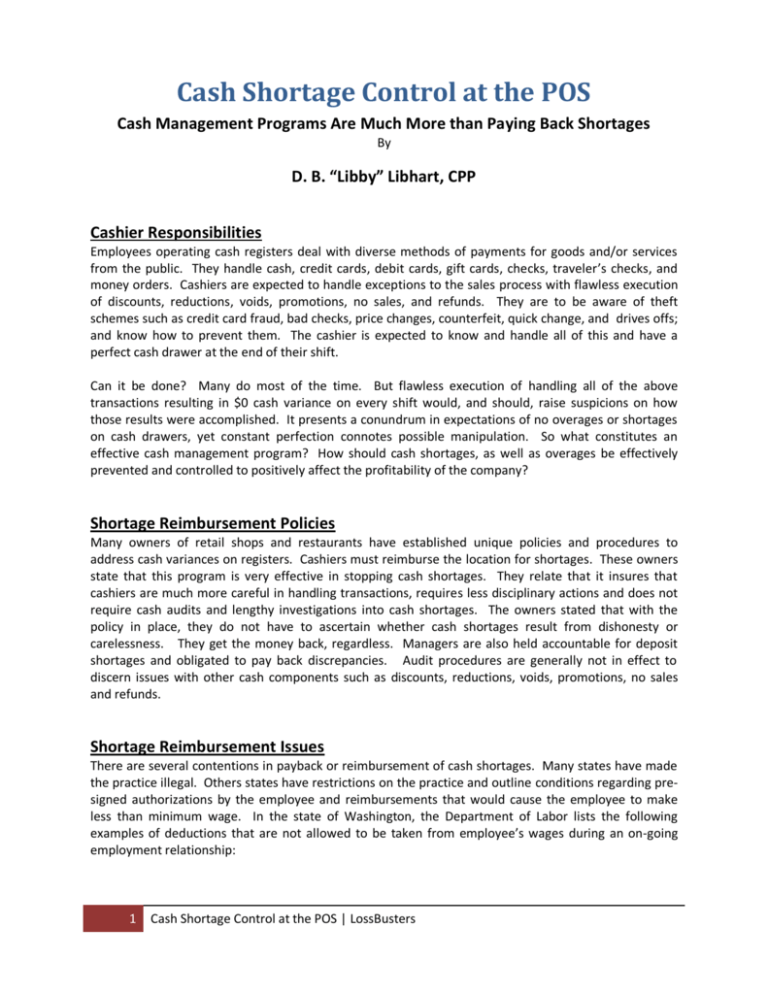

Cash Shortage Control at the POS

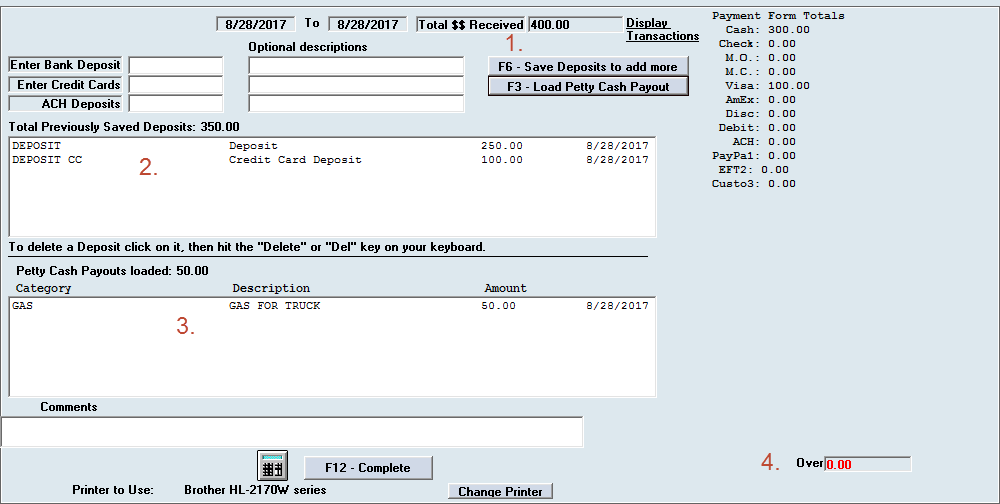

Help Desk > Reconciling Overages and Shortages in your Drawer

Why you can't get change at the grocery store coin shortage

The surprising economic consequences of the coin shortage

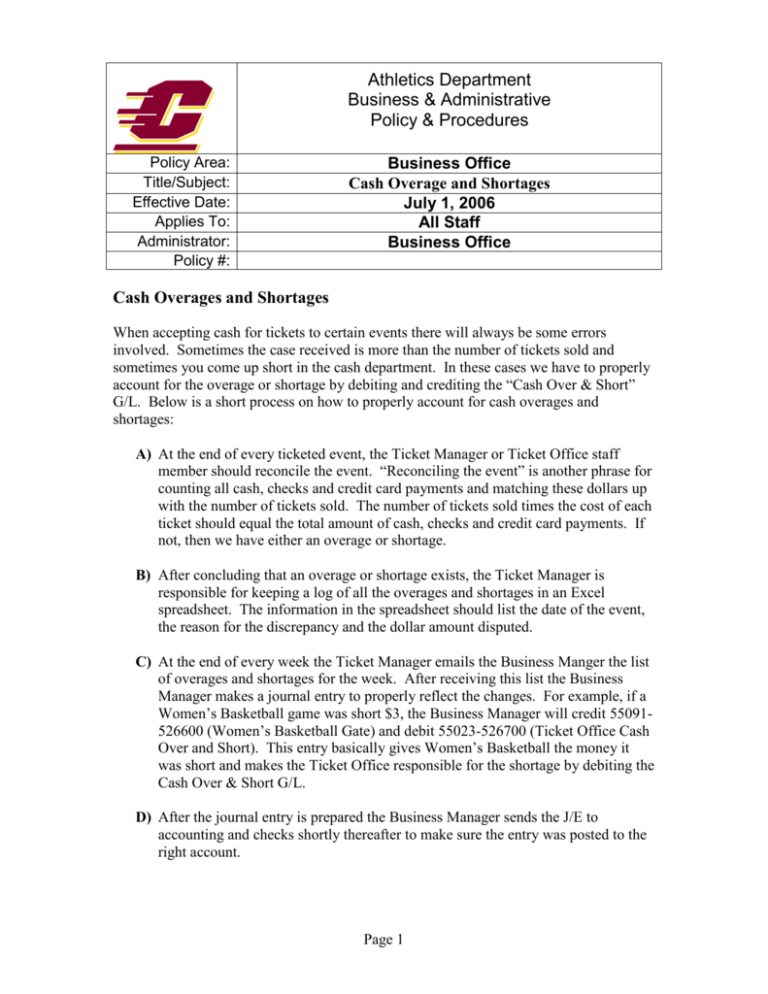

Cash Overages and Shortages

Cashier Deposits & Shortage Policy Your Business

Some Of The Common Rules That States Adopt For When Deductions Are Allowed Include:

Web Federal Law Allows Employers To Charge Employees For Items They Break Or For Shortages In Their Cash Register Drawers Provided The Affected Employee Still Earns At Least The Minimum Wage.

Web Paycheck Deductions For Cash Register Shortages And Breakage Some Employers Charge Employees For Items They Break Or For Shortages In Their Cash Register Drawers.

No, The Employer Can Generally Not Dock You Pay Or Take Money From You.

Related Post: