Paying Back A Recoverable Draw

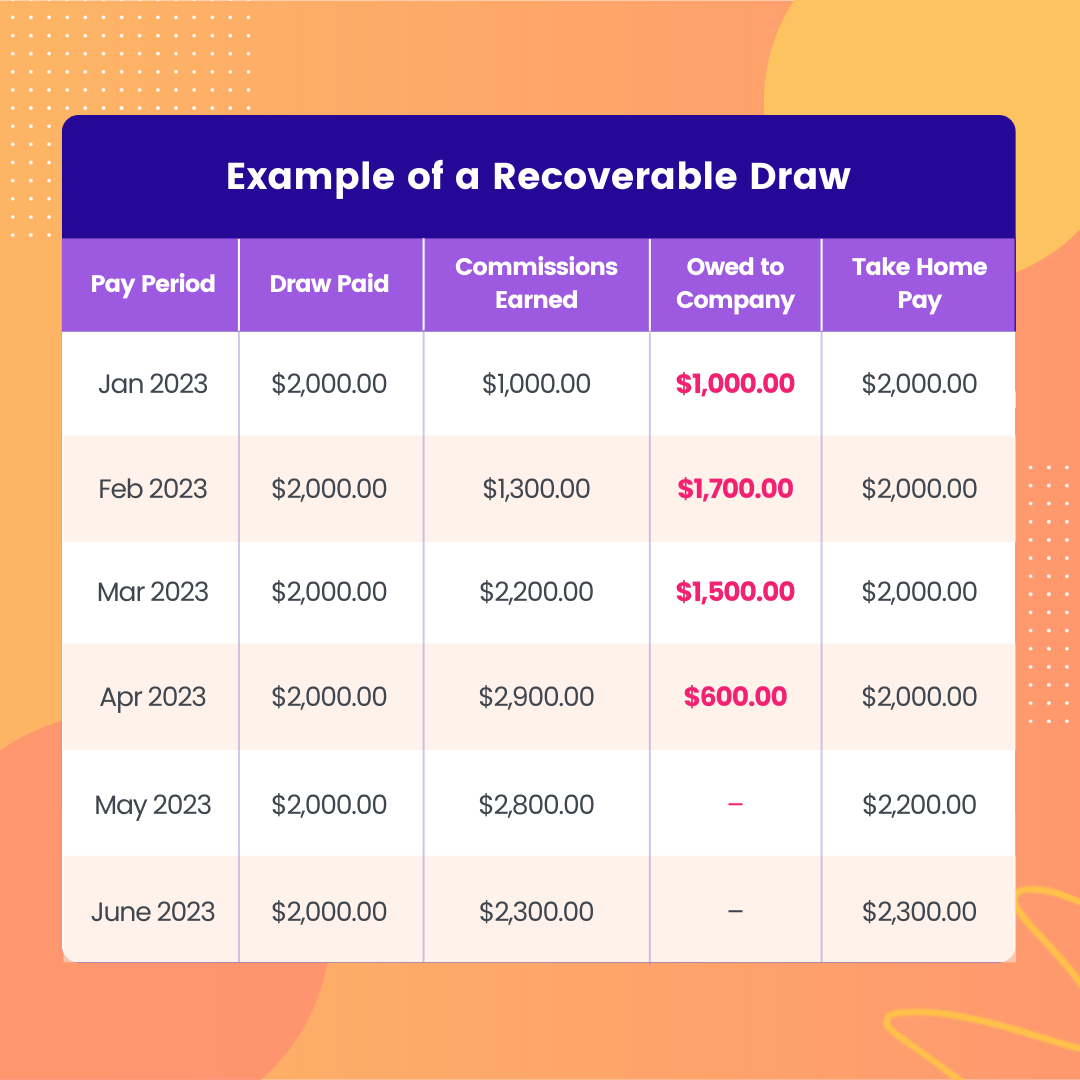

Paying Back A Recoverable Draw - If the employee earns more in commissions than the draw amount, the employer pays the employee the difference after the commissions have been earned. Web a recoverable draw is a payout that you expect to gain back. Recoverable draws (the difference between total pay and commissions earned) allows reps to get paid up front, but the company will recover the draw payments from earned commissions over time. Learning about this style of payment can help you decide if a commission draw salary works for you. A forgivable draw against commission is a type of draw in which the employee is not required to pay back any amount that was drawn if certain criteria are met. Is this correct or am i only responsible for the net amount? Web for recoverable draws, the salesperson pays the balance they owe from previous draws as soon as they start earning commission. Web when reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. This type of draw is common in sales roles where employers want to incentivize their employees to meet certain goals or targets. Welcome back to our series on the deadly sins of incentive compensation. The company is asking for the full amount of the draw to be repaid, even though i have paid taxes on the draw. Web for recoverable draws, the salesperson pays the balance they owe from previous draws as soon as they start earning commission. Web if the rep ends up earning $3,000 in commissions the following month, they must first. Web a recoverable commission draw requires that an employee repay any portion of their draw that is greater than the total commissions they earned for the month. Randall bolten and bob berry. Because of the potential for repayment, salespeople might feel more incentivized to meet or exceed their sales. In other states, such as new york, companies cannot recover the. The company assumes the risk. Welcome back to our series on the deadly sins of incentive compensation. Web if the rep ends up earning $3,000 in commissions the following month, they must first pay back the $1,000 balance, bringing their total payout down to $2,000. Once their draw balance has been paid off entirely, they will receive the full amount. Web employees who received a draw were required to repay it, by deducting the amount of the outstanding draw from the next paycheck. Web for recoverable draws, the salesperson pays the balance they owe from previous draws as soon as they start earning commission. When the amount of commission earned is more than the draw, the salesperson receives the draw. In other states, such as new york, companies cannot recover the outstanding draw if the employee leaves for another opportunity. The risk is shifted onto the salespeople, who must pay back any shortfall in their commission earnings from the previous month. Web if the rep ends up earning $3,000 in commissions the following month, they must first pay back the. If the employee earns more in commissions than the draw amount, the employer pays the employee the difference after the commissions have been earned. Hhgregg's policy provided that upon termination of employment,. In general, collecting outstanding draw amounts are very difficult to do. When the amount of commission earned is more than the draw, the salesperson receives the draw amount. Is this correct or am i only responsible for the net amount? Web if the rep ends up earning $3,000 in commissions the following month, they must first pay back the $1,000 balance, bringing their total payout down to $2,000. Randall bolten and bob berry. Web when the commissions are earned, the salesperson pays back the draw. Web in some. A recoverable draw is a payout you make with an opportunity to gain back if an employee doesn't meet expected goals. Recoverable draws (the difference between total pay and commissions earned) allows reps to get paid up front, but the company will recover the draw payments from earned commissions over time. Web when the commissions are earned, the salesperson pays. Web employees who received a draw were required to repay it, by deducting the amount of the outstanding draw from the next paycheck. For example, if you give an employee a draw of $2,000 per month, you expect the employee to earn at least $2,000 in commissions each month. The amount they owe is taken from the commission they earn.. Web a commission draw is one type of pay that advances commission payments to salespeople before the sales cycle closes. Web a recoverable draw is a payout that you expect to gain back. Web i am paying back a recoverable draw due to an early employment separation. Web when the commissions are earned, the salesperson pays back the draw. The. Web reduces administrative costs: Web the kentucky federal court ruled that a draw in which the sales person must potentially return the money back to the company is not called compensation as per the professional capacity exception. This type of draw is common in sales roles where employers want to incentivize their employees to meet certain goals or targets. Web this form of draw is known as a recoverable draw. Lower financial risk for employers: In general, collecting outstanding draw amounts are very difficult to do. Web for recoverable draws, the salesperson pays the balance they owe from previous draws as soon as they start earning commission. Because of the potential for repayment, salespeople might feel more incentivized to meet or exceed their sales. Web i am paying back a recoverable draw due to an early employment separation. Web in some states, companies can demand repayment of the outstanding draw with legal recourse. Is this correct or am i only responsible for the net amount? A recoverable draw is a fixed amount advanced to an employee within a given time period. When the amount of commission earned is more than the draw, the salesperson receives the draw amount plus whatever is left over after the draw balance is paid off. In other states, such as new york, companies cannot recover the outstanding draw if the employee leaves for another opportunity. Web when reps receive a draw that must be paid back to their company it is considered a recoverable draw because the company is able to recover the funds they paid the rep in advance of earning their commission. A forgivable draw against commission is a type of draw in which the employee is not required to pay back any amount that was drawn if certain criteria are met.

FAQ What Are The Pros and Cons of Straight Commission Plans?

Outside Sales Offer Letter with Recoverable Draw CleanTech Docs

Sixth Circuit Cries Foul on PostTermination Repayment of Recoverable

Recoverable Draw Spiff

Effective AND Fair Sales Compensation Plan Blueprints [With Examples

Recoverable Draw Spiff

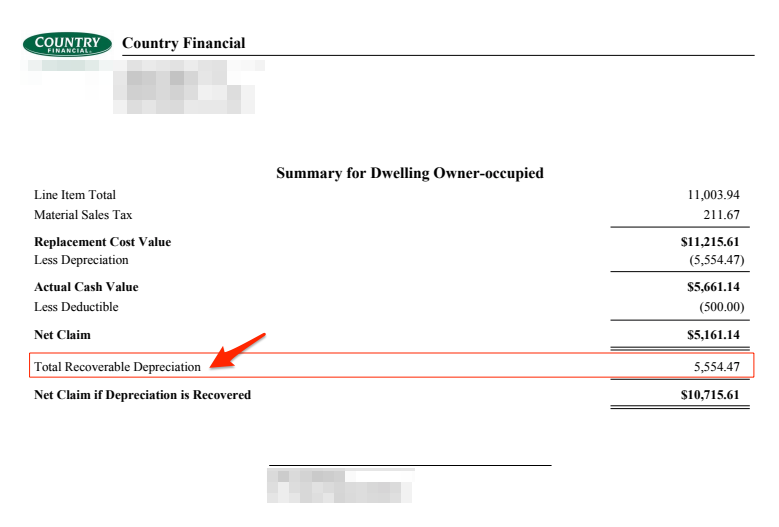

How Recoverable Depreciation Works

Recoverable Draws on Vimeo

Recoverable Draw Spiff

Recoverable and NonRecoverable Draws » Forma.ai

The Amount They Owe Is Taken From The Commission They Earn.

It Often Acts As A Loan For Earning Sales Commissions, And If An Employee Earns Less Than What They Received In A Draw, They Owe The Difference Back To The Company.

A Recoverable Draw Is A Payout You Make With An Opportunity To Gain Back If An Employee Doesn't Meet Expected Goals.

This Is Done So That The Employee Can Cover For Their Basic Expenses.

Related Post: